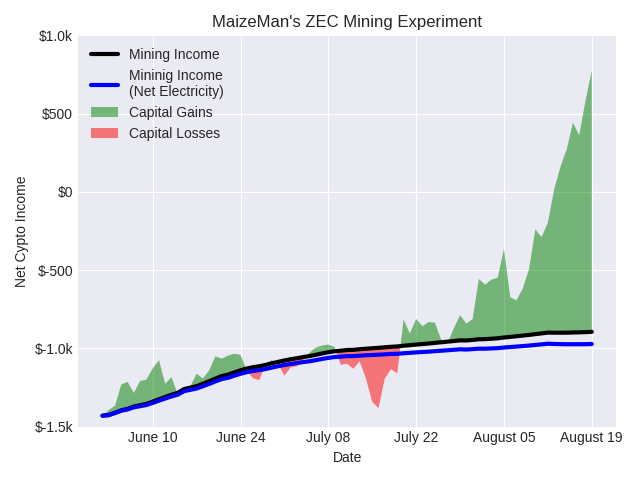

So embarrassingly my idea build a mining income for income seems to have been a quite poor one, while holding cryptocurrency has really paid off in the last month. Had to reset my y-axis and move the legend to the other side of the graph to make room for all the capital appreciation.

Recent flatness of the mining income line reflects my main miner going down for most of the last week while I was out of town. I'm now in the black overall for the experiment in cryptocurrencies, although as will be explained below, that is really in spite of my attempt to be a miner rather than because of it. ;-)

maizeman I was thinking about your mining experiment, what would it look like if you added a line to account for mining income minus opportunity cost of the hardware? Not sure what the fair equivalent would be, if you sunk the equivalent cost of the hardware into the same coin you mine at the beginning and let it appreciate perhaps

So I started out with approx. ~$1,130 in leftover bitcoins and spent ~$1,430 on my mining equipment in early June. Let's leave aside the existing bitcoin holdings (which are really the only thing that pulled my portfolio into the black).

Right now my mining income is worth $1,050 (so -$380 in the hole).*

If I'd spent the money for my mining gear on bitcoins, I'd have $2,950 today ($1,520 in capital gains, plus initial principal).**

If I'd spent the money for my mining gear on zcash, I'd have $1,320 (-$110 in capital capital losses, plus initial principal).

If I'd spent the money for my mining gear on an S&P index fund I'd have $1,430 (essentially my initial principal)

Now mining continues to be profitable for my machine even net of electricity costs and may well remain so for several months (or maybe even into the winter), so it is quite possible that I'll catch up to the "just buy a buy of zcash" or "be a responsible person and sweep your excess hobby money into your stash to buy index funds." It's quite unlikely I'll catch up to "put it all on bitcoins" but if I'm being honest with myself about my state of mind in early June I was much more excited about zcash than bitcoin so the second scenario was a more likely outcome than the first. Easy with the benefit of hindsight, huh?

*If I'd been selling my mining income as it came in I'd have $530 ($900 in the hole).

**Includes the value of bitcoin cash in addition to bitcoin for bitcoins held in private wallets on the day of the fork.